philadelphia wage tax rate

For years before 2021 payments are made towards the annual filing period. Effective July 1 2021 the rate for residents is 3.

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

The City Wage Tax is a tax on salaries wages commissions and other compensation.

. Non-residents who work in Philadelphia must also pay the City Wage Tax. In the state of California the new Wage Tax rate is 38398 percent. The tax was made possible by the Sterling Act a Depression-era state law that allowed the city to earn revenue by passing special taxes.

Who is Subject to Wage Tax. The Earnings Tax rates in the new fiscal year are therefore 38712 038712 for residents and 35019 035019 for non-residents. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

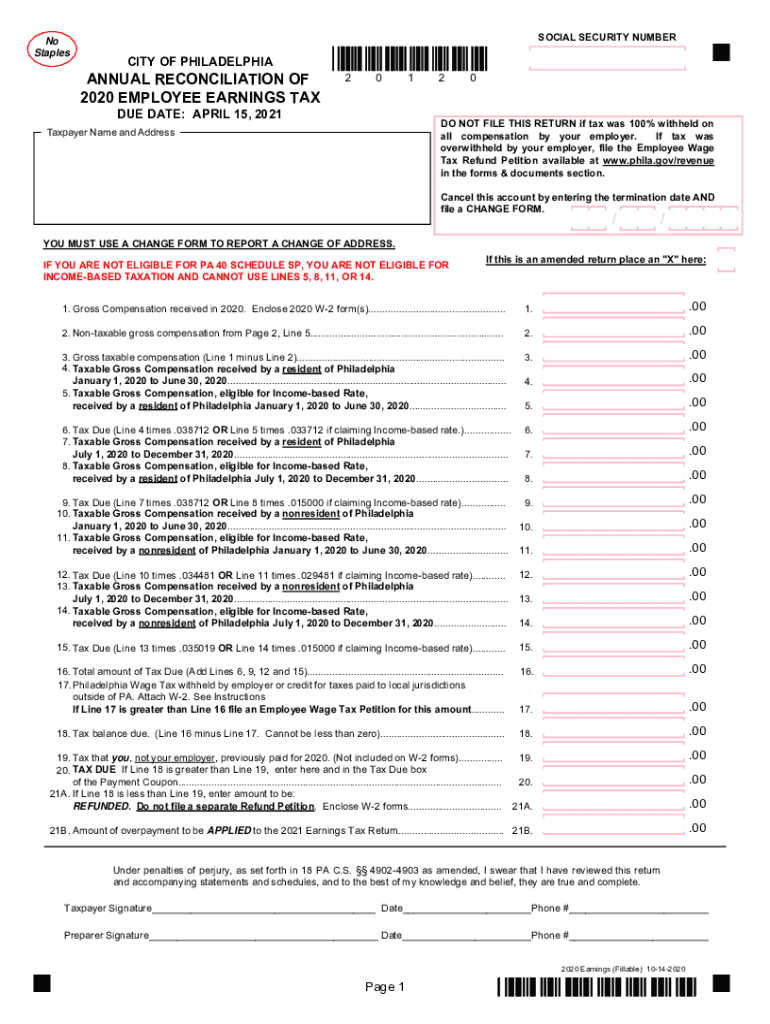

Earnings Tax employees Due date. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer.

FREE Paycheck and Tax Calculators. See below to determine your filing frequency. The main difference is how the tax is collected and paid to the City of Philadelphia.

What Is Philadelphia City Wage Tax. For residents and 34481 for non-residents. 1983 1995 496 on unearned income.

Philadelphia Income Tax Rate 2021. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center. The lower income-based rate is 15 percent for both residents and non-residents regardless of residency.

The rate for residents remains unchanged at 38712. Non-residents who work in Philadelphia must also pay the Wage Tax. The City of Philadelphia announced that effective July 1 2020 the Wage Tax rate for nonresidents is 35019 an increase from the previous rate of 34481.

The employee rate for 2022 remains at 006. The Earnings Tax closely resembles the Wage Tax. CITY AND SCHOOL DISTRICT OF PHILADELPHIA Revised June 24 2019.

The Federal income brackets are from 10 to 37 for the year 2021. Services without an account. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019.

SUMMARY SCHEDULE OF TAX RATES SINCE 1952. In 1939 Philadelphia became the first city nationwide to implement a wage tax at a rate of 15 percent. What is Philadelphia city tax.

City of Philadelphia Wage Tax. Nonresidents who work in Philadelphia are subject to a 350 percent local income tax which is 043 percent lower than the 350 percent local income tax paid by Philadelphia residents. Contents 1 Do I have to pay Philadelphia city wage tax if I work from home.

For residents of Philadelphia or 34481 for non-residents. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Bounce rate traffic source etc.

For specific deadlines see important dates below. The standard deduction is 12550 single and 25100 married filing jointly for the year 2021. Effective July 1 2021 tax rates are 38398 for Philadelphia residents and 34481.

In todays blog we will discuss the Philadelphia Wage Tax Refund process for 2020. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481. For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers.

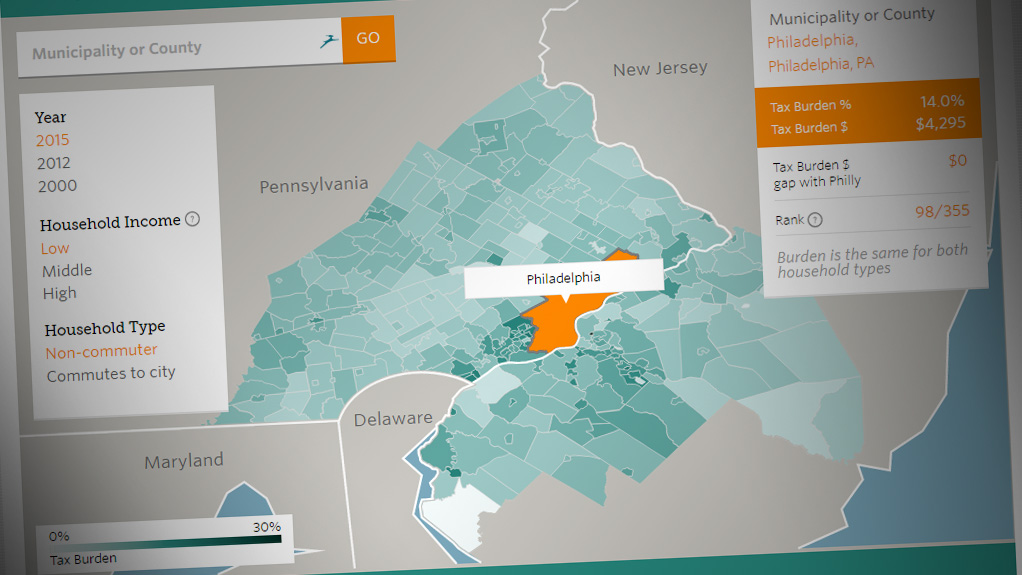

Wages subject to unemployment contributions for employers remains at 10000. Quarterly plus an annual reconciliation. When you focus on tax rates you quickly see that Philadelphias resident wage tax is higher than any other city in the nation except New York.

Employees who are non-residents of Philadelphia and work for employers in the city are subject to the Philadelphia Wage Tax at a rate of 35019. Single or Married Filing Separately. The new rates are as follows.

News release City of Philadelphia June 30 2020 Similarly the Philadelphia nonresident Earnings Tax and Net Profits Tax NPT. The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

For income-based rates to apply you must. All Philadelphia residents owe the City Wage Tax regardless of where they work. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of.

Wages subject to unemployment contributions for employees are unlimited. The wage tax grew over time reaching its highest rate of 496 percent for residents in 1985. School Income Tax 1967 1975 200 on unearned income School District 1976 1982 43125 on unearned income.

The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. Be certain your payroll systems are updated to reflect the increased non-resident tax rate. The tax rate and payment due dates for the Liquor Tax are not changing.

The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. The Philadelphia City Wage Tax is a tax on earnings applied to payments that an individual receives from an employer for work or services. And because NYC has a progressive local income tax its higher rates apply only to higher-income householdsHigh tax rates mean less earned income goes into the pockets of our residents as demonstrated by studies.

The July 1 st city wage tax increase will take effect the same week that Philadelphia moves into the green phase for businesses to reopen. Additionally to the Pennsylvania income tax and the Federal income tax residents of Philadelphia pay a flat city income tax of 393 percent on their earned income which is on top of the state. The new Wage Tax rate for non-residents of Philadelphia who are subject to the Philadelphia City Wage Tax is 34567 034567.

Furthermore the rate of Earnings Tax for residents. After gross income less standard deduction that is taxable income subject to. Employers collect the Wage Tax from a workers paycheck and remit it to the.

City Announces Wage Tax Reduction Starting July 1 2017 Department Of Revenue News City Of Philadelphia

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Philadelphia City Council Unveils 5b Budget Whyy

Philadelphia Tax Rate Changes Starting July 1st Haefele Flanagan

Tax Record Retention Guidelines Let S Get Organized What And When Can I Toss It Records Estate Administration Estate Planning

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

2020 Philadelphia Tax Rates Due Dates And Filing Tips

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Live Casino Hotel Philadelphia Donated 15 000 To Philabundance For Hunger Relief Philadelphia Hotels Casino Hotel Casino

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts